Getting My Medicare Advantage Plans Tampa To Work

Table of ContentsAn Unbiased View of Medicare Advantage Plans TampaSome Of Medicare Advantage Plans TampaNot known Details About Medicare Advantage Plans Tampa Medicare Advantage Plans Tampa Can Be Fun For EveryoneMedicare Advantage Plans Tampa Can Be Fun For AnyoneNot known Facts About Medicare Advantage Plans TampaExamine This Report about Medicare Advantage Plans TampaThe smart Trick of Medicare Advantage Plans Tampa That Nobody is DiscussingLittle Known Questions About Medicare Advantage Plans Tampa.

You can make use of the cash in your MSA to pay your clinical expenses (tax obligation free). You have complimentary selection of suppliers. The providers have no limit on what they bill. Surefire Issue: The plan must register you if you fulfill the needs. Treatment has to be available 24 hrs daily, 7 days a week.Physicians should be allowed to educate you of all treatment options. The strategy has to have a complaint as well as appeal procedure. If a layman would certainly think that a symptom can be an emergency, then the strategy should spend for the first aid. The strategy can not charge even more than a $50 copayment for sees to the emergency area.

Indicators on Medicare Advantage Plans Tampa You Need To Know

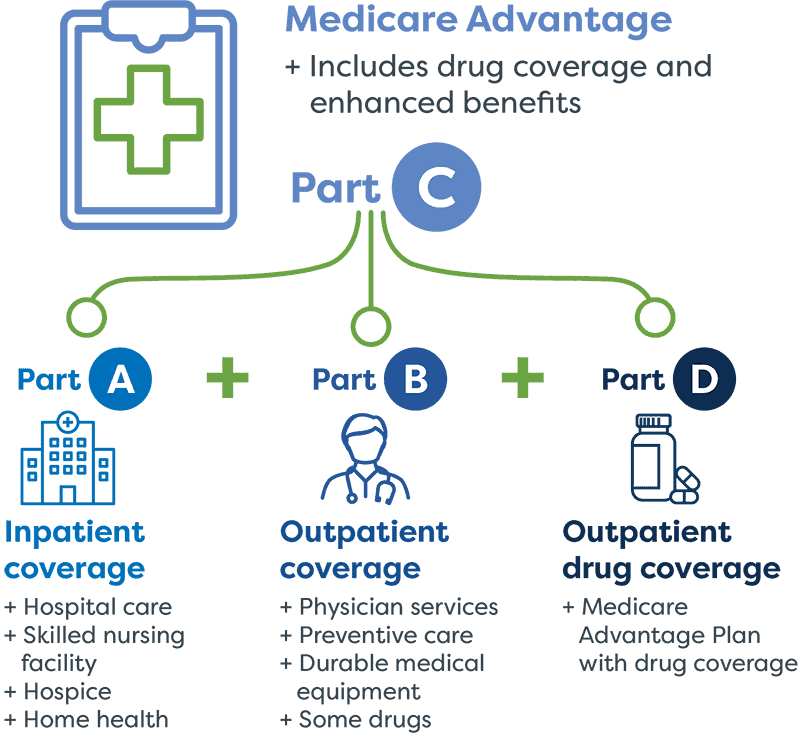

You do not need a reference from your medical care physician. All plans have a contract with the Centers for Medicare and also Medicaid Provider (Medicare). The plan should sign up any individual in the solution area that has Part An as well as Component B, besides end-stage kidney illness people. Each strategy should use a yearly registration duration.

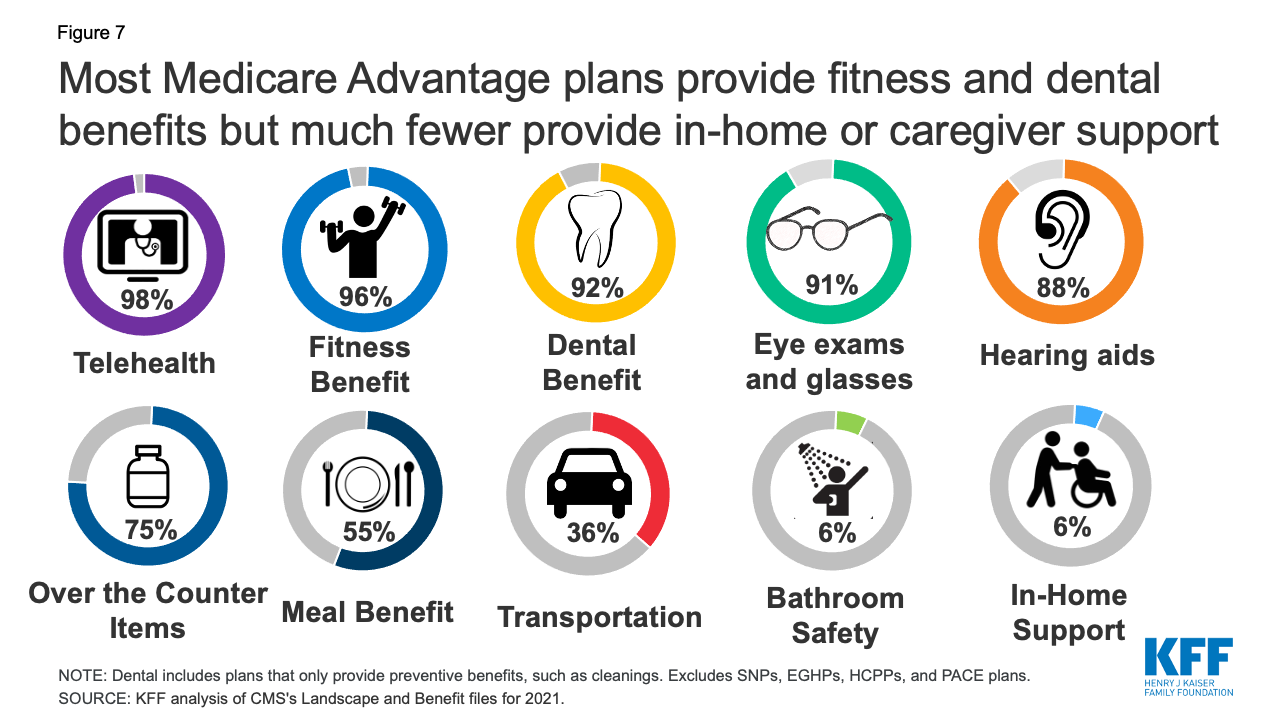

You pay any plan premium, deductibles, or copayments. All plans may offer extra advantages or solutions not covered by Medicare. There is normally much less documents for you. The Centers for Medicare as well as Medicaid Solutions (Medicare) pays the strategy a collection quantity for every month that a recipient is signed up. The Centers for Medicare as well as Medicaid Solutions checks allures and also advertising plans.

Little Known Questions About Medicare Advantage Plans Tampa.

If you fulfill the following needs, the Medicare Benefit strategy need to enroll you. You might be under 65 and you can not be refuted coverage due to pre-existing problems. You have Medicare Component An as well as Part B.You pay the Medicare Part B costs. You reside in an area serviced by the plan.

You are not obtaining Medicare due to end-stage kidney illness. An additional kind of Medicare Managed Health Care Company is an Expense Agreement HMO. These strategies have different demands for enrollment. You have Medicare Component An and also Component B, or only Part B.You pay the Medicare Part B costs. You stay in a county serviced by the strategy.

How Medicare Advantage Plans Tampa can Save You Time, Stress, and Money.

You do not need a Medicare supplement policy. You have no costs or claim forms to finish. Declaring and also organizing of insurance claims is done by the Medicare Benefit strategy. You have 24-hour access to solutions, including emergency situation or urgent care with suppliers outside of the network. This consists of foreign traveling not covered by Medicare.

Not known Facts About Medicare Advantage Plans Tampa

The Medicare Benefit strategies must enable you to appeal rejection of cases or solutions. If the service is still rejected, after that you have various other allure rights with Medicare. You need to live within the service location of the Medicare Advantage strategy. have a peek here If you relocate beyond the service area, then you must sign up with a various plan or get a Medicare supplement plan to opt for your Initial Medicare.

(Exception: PPOs allow you to use suppliers beyond the network, as well as Medicare will still pay 80% of the approved quantity. PFFSs do not have a network of carriers, but your service provider might decline the strategy.)Your existing medical professional or hospital may not be component of the Medicare Benefit network so you would have to pick a new doctor or hospital.

Some Ideas on Medicare Advantage Plans Tampa You Should Know

A supplier could leave the strategy, or the plan's agreement with Medicare can be canceled. You would have to locate one more Medicare Advantage strategy or obtain a Medicare Supplement Plan to go with your Original Medicare. If your Health Care Doctor (PCP) leaves the strategy, then you would need to choose one more PCP. medicare advantage plans tampa.If you live beyond the plan area for 12 or more months straight, the Medicare Benefit strategy may ask you to disenroll as well as re-enroll when you go back to the location.

These defenses will allow recipients, in particular situations, to try a plan, however after that return to Original Medicare as well as a Medicare Supplement plan if they intend to do so. Under these protections, beneficiaries will have warranty concern of a Medicare Supplement policy as long as they meet one of the following requirements.

Fascination About Medicare Advantage Plans Tampa

Nonetheless, to receive these securities, recipients need to obtain a supplement plan within 63 days of disenrolling from the health insurance plan, or within 63 days of the discontinuation of the health insurance plan. A beneficiary would be qualified for the Medicare Supplement securities if they meet among the complying with requirements.

The plan solution location no longer covers the county where you live. Security: In this case, you would certainly get an assured problem of a Medicare Supplement Strategy A, B, C, or F from any type of company (as long as you use within 63 days of losing your various other insurance coverage) (medicare advantage plans tampa).

The 9-Minute Rule for Medicare Advantage Plans Tampa

The 8-Second Trick For Medicare Advantage Plans Tampa

The Cost Contract HMO would certainly not special info pay these. Cost Contract HMOs might enroll you if you do not have Medicare Component A yet have and spend for Medicare Component B. Cost Contract HMOs do not need to enlist you if you have end-stage kidney disease or are currently registered in the Medicare hospice program.

If you enroll in a personal fee-for-service, you can obtain care from any type of Medicare medical professional that consents to the strategy's terms, yet you must stay in the strategy's solution location to be qualified. Medicare pays the plan a collection amount every month for each and every recipient enrolled in the plan. The plan pays carriers on a fee-for-service basis.